The knowledge economy accounts for more than 10% of U.S. employment and almost 20% of national GDP. Not only limited to the U.S., Eurostat 2020 also aims to increase the investment in Knowledge Intensive Business Services (KIBS) to bypass the competitors, Japan and the U.S. Cities around the world pay an extensive attention to their economic development and thus seek robust local knowledge economy.

In the knowledge economy discourse, two categories of industries play a critical role in increasing innovation productivity. First are the so-called creative or cultural industries, those establishments — for-profit, nonprofit, and public — that develop cultural goods and social services. These industries have a weak connection with Science, Technology, Engineering, and Mathematics (STEM).

This post-industrial shift from a commodity-based industrial economy to a knowledge-based economy has been also accompanied by extensive attention to the Knowledge-Based Urban Development (KBUS) policies. These policies seek to incorporate both locational and non-locational determinants that attract these two categories of businesses. According to the literature, the non-locational factors include racial diversity, sexual diversity, and share of bohemian workers which establish a social trust for further face-to-face contacts and attract creative class. On the other hand, the locational determinants include spatial clustering (increasing agglomeration externalities), proximity to Central Business Districts (CBDs), and place quality amenities.

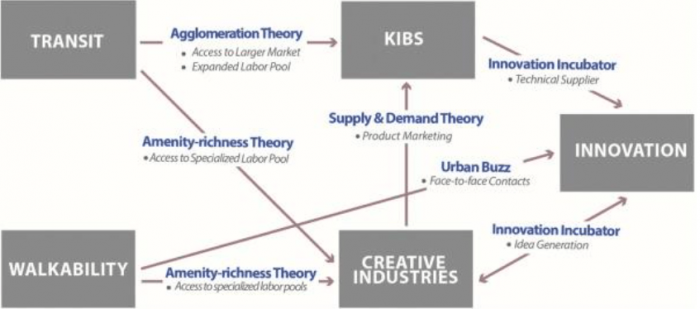

These amenities attract the creative class, talents, and KIBS, and thus, lead to a robust knowledge economy. Density and land-use diversity also enhance the face-to-face contacts and embed an urban buzz which leads to innovation productivity while attracting talents. Walkability and public transit are also the key locational determinants that contribute to a robust local knowledge economy, although received less attention. Transit and walking amenities are the place quality preferences of the skillful millennials responding to their car-free lifestyle. Moreover, transportation infrastructure expands access to the suppliers as well as widening firms’ customer and labor market areas.

What is less clear is whether the mechanism to which transportation infrastructure could affect innovation is similar for creative industries versus KIBS. Furthermore, how does it compare to other locational and non-locational drivers of innovation? While several studies have stated these relationships theoretically, there is little empirical evidence into such a mechanism of impacts.

A recent study examined whether and to what extent transit and walking amenities impact knowledge industries, creative enterprises, and innovation productivity. Employing Structural Equation Modeling (SEM), this study measures both direct and indirect impacts of transit and walking amenities. Using ESRI Business Data Source (EBDS) and Small Business Innovation Database (SBIDB), this study is one of the first attempts at the national level to combine address-level datasets on the location of firms and innovations in the U.S. Hence, this attempt pushes forward the analysis of the relationships between indicators of robust neighborhood-level knowledge economy, transit service quality, and walkability.

Fig. 1. Theoretical framework demonstrating the links between transit, walkability, and the knowledge economy at the neighborhood level. Image republished with permission from Elsevier from https://doi.org/10.1016/j.cities.2018.04.005

| Table 1: Descriptions of model variables | |

| Innovation | Natural logarithm-average number of innovation awards between 2013 and 2015 using Small Business Innovation Database |

| Creative Firms | Number of creative firms in a neighborhood, computed using EBDS |

| KIBS | Number of KIBS firms in a neighborhood computed using EBDS |

| Population density | Population divided by gross land area in square miles, computed using the Census data 2010 |

| Location quotient (Industry Clustering) | Location quotient/Industry Clustering for the qualified businesses for the SBIR grant program computed using EBDS |

| Transit | transit service frequency in every neighborhood using Smart Location Database-Environmental Protection Agency |

| Walk | Predicted number of walk trip in every neighborhood computed using National Household Travel Survey Database |

| Amenity | Number of amenities (restaurants, café’s, discos, nightclubs, theatres/concert halls, museums, cinemas, sports facilities, recreation areas, and public libraries and parks) in every neighborhood, computed using the EBDS |

| Racial diversity | Melting Pot index, the percentage of foreign-born people in every neighborhood, computed using American Community Survey |

| Bohemian | Number of authors, designers, musicians, composers, actors, directors,

painters, sculptors, artist print makers, photographers, dancers and performers in every neighborhood, computed using EBDS |

| Job growth | Employment change between 2011 and 2014 computed using Longitudinal Employment Household Dynamics |

| Distance to CBD | Distance from a neighborhood ‘s population centroid to the closest Central Business District (CBD) |

This study aims to quantify the theoretical framework representing the impact of transit and walking amenities in the knowledge economy as illustrated in Figure 1.

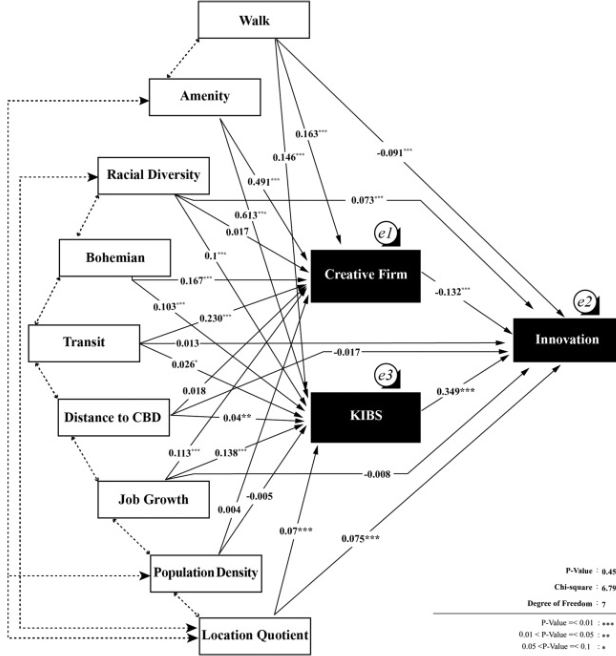

Fig. 2. Causal path diagram for block group level walkability, transit quality, and innovation production. Image republished with permission from Elsevier from https://doi.org/10.1016/j.cities.2018.04.005

Figure 2 represents the best-fitted model. Causal pathways are illustrated via straight uni-directional arrows and dashed bi-directional arrows represent correlations with the standardized regression coefficients above the lines. The asterisks indicate that the coefficients are significant with >90% level of confidence. This sample includes 3088 U.S. neighborhoods (census block groups) with at least one innovation award between 2013 and 2015. For the measure of innovation counts, the analysis uses the Small Business Innovation Research (SBIR) and the Small Business Technology Transfer (STTR) data provided by the U.S. Small Business Administration (SBA). SBIR/STTR is a U.S. government program supporting STEM-based innovations with commercial value at the small firms. The SBIR qualified firms have < 500 employees and are usually among computer science, process control instrument, radio and TV communication.

The results suggest that an increase in the number of place quality amenities strongly improves knowledge-based economic vitality by increasing innovation productivity, creative class size and number of KIBS. Furthermore, the firm clustering has a strong impact as increases knowledge spillover, access to suppliers and a larger labor pool. On the other hand, walkability significantly contributes to the creative class size, number of KIBS but not to the innovation productivity of SBIR firms.

Transit quality also attracts KIBS and creative class however has a negative and significant impact on the innovation output of SBIR firms. The qualified firms for the SBIR grants are limited to high-tech and STEM-based (among <10 industrial sectors) with fewer than 500 employees. These firms are seeking the SBIR grant in order to innovate new products and, as a result, grow. Their restricted resources, however, might limit them in their location decisions.

Although walkable places (such as greenbelt new towns, neo-traditional subdivisions, or urban and suburban centers like CBDs) and transit accessibility are widely accepted to bring a variety of environmental and social benefits, one major drawback is their potential role in increasing property values and costs. Hence, these innovative small firms might not be able to afford to locate in walkable and transit-accessible places. This explanation is even more plausible as it supports the same findings from the impact of proximity to CBD in this analysis. Although transit quality possesses a positive direct impact on innovation, again this effect is insignificant. Since office values increase as the result of proximity to transit stations, again it is possible that the small innovative firms could not afford to locate in the transit and pedestrian friendly neighborhoods, despite the general belief about the impacts of walkability and transit quality. These findings on the impacts of walkability and transit access on innovation productivity in vulnerable small firms call for attention to the equity aspects of innovation-supportive urban developments.

Another interesting finding is that while creative industries do not have a significant impact on innovation production, KIBS significantly play a critical role. Creative industries contribute to innovation production through the expansion of the skilled labor pool, innovation commercialization and marketing. This might not be the case for the SBIR innovative firms due to their small size and limited scope of works and products that usually do not lead to commercialization and marketing. On the other hand, KIBS are very likely to collaborate in the innovation process with other firms which makes the geographical proximity to KIBS a critical factor. KIBS provide technical input and R&D services which significantly contribute to small firms throughout the innovation process.

These findings call for more innovation friendly place-based policies and plans. While federal organizations (like SBA) support innovation production, localities also can develop the complementary policies that enhance the proximity of STEM small firms or startups (like SBIR firms) to KIBS clusters which can be in form of a regional innovation hub zoning. According to these recent findings, such hubs are best to locate near CBDs, be walkable and accessible via transit systems, and accommodate place quality amenities to satisfy KIBS’ locational demands.

These findings are described in the article entitled Impacts of transit and walking amenities on robust local knowledge economy, recently published in the journal Cities. This work was conducted by Ahoura Zandiatashbar and Shima Hamidi from the University of Texas at Arlington.