Technological innovations are often driven to the market thanks to the hedonistic lifestyle of the consumers. In such cases, the technology adoption or adaptation is quite fast and smooth. People are not only willing to pay a premium price for a new generation of smartphones but also line up early morning in front of stores to buy one. The situation is a bit different for battery electric vehicles (BEVs) as a technological innovation in the transport sector.

Today, BEVs have a negligible share (<1%) in the global market of passenger cars in spite of public awareness about the environmental benefits from the electrification of road transport. The BEVs of today are propelled by the energy stored in a lithium-ion battery pack (LIBs) and so have a zero tailpipe emission. This unique selling point, however, seems to be too dulled by the high price tag and limited driving range compared to the conventional internal combustion vehicles (ICVs). Are the LIBs the only one to be blamed for the insignificant penetration of BEVs to the car market?

We recently introduced a technical index that is the algebraic product of driving range and max-speed of a vehicle, i.e., Mobility Diffusion Coefficient (MDC). This coefficient enables us to more accurately juxtapose BEVs with ICVs from a technical and price point of view. MDC is simply a rough measure of the mobility power of a vehicle: vehicles characterized by higher MDC can drive a longer distance at a shorter time with a full tank or a fully charged battery. While this index correlates to the engine and the tank size of an ICV, in a BEV, it is mainly determined by the energy capacity of the battery pack which is reported in kWh. To better understand the importance of MDC, let’s analyze a group of BEVs and ICVs from the passenger car market in 2016-2017.

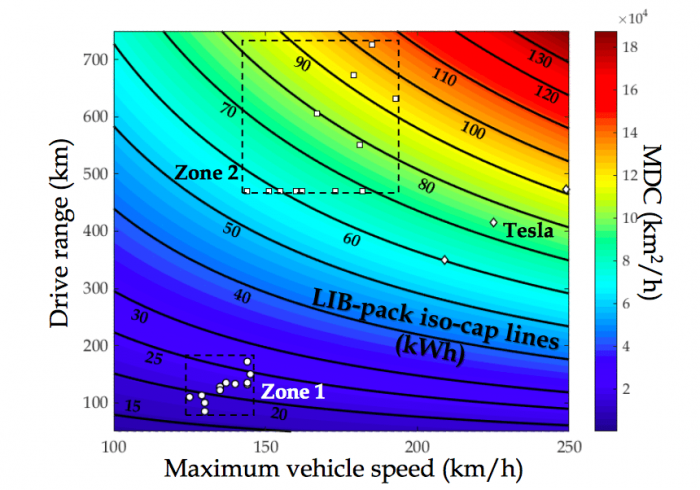

We built a sample composed of 13 BEV/ICV pairs together with three BEV models from Tesla (S-60D, S-75D, and S-90D). In each of 13 pairs, technical specifications (speed, torque, number of seats) are closely shared between the BEV and ICV, and both vehicles are selected from the same car manufacturer: Smart, Peugeot, Citroen, Chevrolet, Nissan, Volkswagen, Fiat, Renault, Kia, and Ford. Not surprisingly, we find a decent correlation between the MDC of the BEVs and the size of battery packs. This correlation is visualized with the help of a contour map in Figure 1.

Figure 1. An approximate contour plot for the capacity of a LIB battery-pack in a mid-size BEV as a function of driving range (km) and maximum speed (km/h). Black solid lines are the iso-cap lines for the capacity of the current generation of LIB packs, and the MDC coefficients are color-coded according to the color bar. Two rectangular zones (dashed-dotted) define the technical boundaries for the two groups of potential BEV customers, i.e., early adopters (zone 1) and the late majority (zone 2). The BEVs (white circles) and ICVs (white squares) from our sample, together with Tesla cars (white diamonds), are superimposed on the map for comparison. Source: M. Safari, Energy Policy, (2018) 115: 54-65, republished with permission from Elsevier.

BEVs (white circle) and ICVs (white squares) from our sample together with Tesla cars (white diamonds) are scattered on this contour map. The MDC is color-coded according to the color bar on the right side of the figure. Every black solid line corresponds to a different size of the battery pack and helps us to size the battery for the desired combination of max-speed and driving range. The rectangular zones 1 and 2 represent the technical-satisfaction ranges for the mainstream BEV drivers and ICV drivers, respectively.

These two zones are distinguished by a significant difference (>80%) in their characteristic MDC coefficients, which in turn reveals a clear contrast in the mobility culture between the two groups of drivers. Zone1 represents the vehicles of choice for the true environmentalist, conspicuous consumers, and tech-savvy drivers who are willing to overlook the speed/driving-range limitations of BEVs for other reasons, namely “early adopters.” Zone2, on the other hand, typifies a group of drivers who do not want to give up on any of the technical attributes of ICVs plus those who cannot afford the price premium of a BEV, namely “late majority.” Our analysis shows that the retail price of a BEV, excluding sale taxes (BEVprice), powered by the current generation of LIB packs is proportional to MDC according to the following equation:

BEVprice = 19700 + 0.462 MDC (Eqn.1)

where MDC is in km2/h and BEVprice in $. It can be readily shown, using Eqn.1, that the average price of a BEV for early adopters (zone1) and late majority (zone2) groups are ~28$k and 63$k. These prices are significantly higher than the average price of ICVs in our sample, i.e., ~14$k. Contrary to the common belief, the share of LIB pack in the price of BEVs is ~19% and the rest is covered by 48% ancillary costs (e.g., chassis) and 33% the electric powertrain (e.g., electric motor). In this regard, LIB pack is not the cost determining the component of a BEV and only amounts to ~250$/kWh. We might better use “electrification cost” as a gauge for the price competitiveness of the BEVs which is the ensemble cost of LIB pack, electric powertrain, and the retail margins. The electrification cost of a mid-size BEV is currently around 700 $/kWh.

Now, the important question is this: when will be the price of BEVs on a par with ICVs? The price projections based on the current technological learning rate of BEVs (~9%) suggest that the breakeven price will not be achieved before 2040! This situation, indeed, can be improved if two big revolutions happen. First, significant incentives for BEVs and/or disincentives for ICVs need to be put in place on a global scale. Second, a new mobility culture is required to be institutionalized among the drivers which is more enriched by the environmental self-accountability. Meanwhile, battery scientists must try to develop the next generation of batteries beyond lithium-ion which are less expensive, safer, and more environmentally-friendly.

These findings are described in the article entitled, Battery electric vehicles: Looking behind to move forward, recently published in the journal Energy Policy. This work was conducted by M. Safari from Institute for Material Research (IMO), Hasselt University.