At the 2015 United Nations Climate Change Conference in Paris there was agreement — termed COP21 and then COP23 for its subsequently revised target date — to set a goal of limiting global warming to less than 2 degrees Celsius (°C) compared to pre-industrial levels. Simply stated, these targets aim to reduce the pace of climate change by reducing the demand for fossil fuels.

But what about the macroeconomic impacts of these decisions? It is apparent that sustainable global energy policy must lead to the long-term decline in demand for fossil fuels. This outcome will clearly affect financial markets, especially the fortunes of those global and domestic corporations involved in these far-reaching businesses. For example, the market capitalization of the world’s major energy companies listed on the NASDAQ total US$3.3 trillion (April 20, 2018) and so changes in their valuation will have profound effects on investment portfolios linked to the broad market indices where these shares are included.

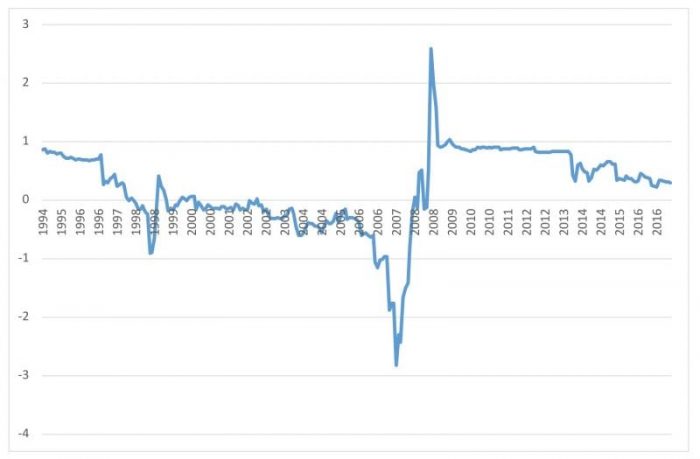

A recent study by Batten, Kinateder, Szilagyi, and Wagner, published in the journal Energy Policy, shows that investors can, in fact, hedge, or diversify, these risks. In their paper, the authors construct an index that tracks the sensitivity of various global developed and emerging market stock portfolios to changes in the price of oil (measured as both West Texas Intermediate (WTI) and Brent). The authors term this a Stock-Oil Integration Index (SOII) with the average SOII estimated over the period 1994 to 2017, illustrated in Figure 1.

Figure 1: Average Stock Oil Integration Index (SOII) 1994 to 2017. The figure plots the average monthly SOII across the eight portfolios: MSCI Emerging Markets; MSCI MXWO (Developed Markets); MSCI ACWI (Emerging and Developed Markets); MSCI Europe; MSCI G7 Countries (Canada, France, Germany, Italy, Japan, the United Kingdom and the United States); MSCI Far East (Japan, Hong Kong and Singapore); MSCI North America (Canada and the United States); S&P 500 (United States only index). (Credit: Jonathan A. Batten)

The key point is that changes in the index over the past almost 30 years identify times when oil sector investors could either diversify (when the SOII is near zero in Figure 1) or hedge oil price shocks (when the SOII is either above — by taking a short position — or below zero — by taking a long position — as shown in Figure 1). A long and short position means either buying or selling oil, respectively, while holding a stock portfolio. In the future, these same time-varying relationships can be used to address changes in fossil fuel demand.

The analysis employs complex statistical analysis based on key theories in finance, termed asset pricing and portfolio theory (e.g. Solnik, 1977; Stulz, 1981), and the authors’ earlier work (Batten, Kinateder, Szilagyi and Wagner, 2017). The study shows that if investors had used the relationships implied by the SOII in the past, they would have received positive economic benefits. Their findings also add to the understanding of the two-way relation between oil and stock market prices, which is also vital for regulatory and macroeconomic policy, both at a national and global level (Bernanke, 2016).

Globalisation, the removal of capital controls and financial market regulatory convergence, over the past 30 years has ensured that financial markets have moved from being segmented and independent, based on either regional geography or level of market development, to being more integrated. Integration measures the degree that price changes in one market affect all markets. Investors can take advantage of these two different states and use them to restructure, or rebalance, their investment portfolios. Sometimes, as the recent Global Financial Crisis (GFC) of 2007-2009 has shown, some economic shocks affect all markets, irrespective of location, although the impacts measured in terms of scale and scope may differ. Since these impacts can be measured using the SOII, they can also either be hedged or diversified, using the various derivative products in financial markets that have been developed in recent years.

Analysis by the authors shows that under normal market conditions, when markets are not integrated (or segmented), there is the opportunity for oil investors to diversify the additional oil price risk, caused by COP21, through the purchase of non-oil sensitive stocks, or those with low sensitivity. When energy and stock markets are highly integrated, there are few diversification benefits to investors. Importantly, during periods of financial market crisis, there is no benefit to investors as markets are highly integrated.

On balance, investors need to move beyond simple purchases of stocks and energy assets, to a more active management of their portfolios, which may also involve taking offsetting positions (e.g. short oil to stock positions). The authors show the cost-saving benefits of a simple buy-and-hold strategy are easily out-performed by more active portfolio management, which considers the degree of integration between oil and stock markets. In conclusion, from an international portfolio management perspective, it should be possible, in the future, to offset the financial effects of declines in fossil fuel demand.

Notes: The stock portfolios comprise the following: MSCI Emerging Markets; MSCI MXWO (Developed Markets); MSCI ACWI (Emerging and Developed Markets); MSCI Europe; MSCI G7 Countries (Canada, France, Germany, Italy, Japan, the United Kingdom and the United States); MSCI Far East (Japan, Hong Kong and Singapore); MSCI North America (Canada and the United States); S&P 500 (United States only index).

These findings are described in the article entitled Addressing COP21 using a stock and oil market integration index, recently published in the journal Energy Policy. This work was conducted by Jonathan A. Batten from the Universiti Utara Malaysia, Harald Kinateder and Niklas F. Wagner from the University of Passau, and Peter G. Szilagyi from the Central European University.

References:

- Batten, J.A., Kinateder, H., Szilagyi, P.G. and N. Wagner (2017). Can stock market investors hedge energy risk? Evidence from Asia. Energy Economics 66: 559-570.

- Batten, J.A., Kinateder, H., Szilagyi, P.G. and N. Wagner (2018). Managing COP21 using a Stock and Oil Market Integration Index. Energy Policy 116: 127-136.

- Bernanke, B. (2016). “The relationship between stocks and oil prices” February 19, 2016 Brookings Institute: http://www.brookings.edu/blogs/ben-bernanke/posts/2016/02/19-stocks-and-oil-prices

- Solnik, B.H. (1977). Testing international asset pricing: Some pessimistic views. Journal of Finance 32(2): 503-512.

- Stulz, R.M. (1981). A model of international asset pricing. Journal of Financial Economics 9(4): 383-406.