The global transition to a low-carbon energy economy needs to capture the flexibility of technological developments (from solar PV development and battery storage to the deployment of small modular reactors) but also the changes in the social, environmental, and governmental requirements for a sustainable energy future.

In our research, we capture this transition from a broad perspective that includes geopolitical, economic, environmental, and financial parameters of a newly-defined concept known as the Regional Energy Hub (REH).

The global energy sector is facing two overarching long-term energy policy requirements for this transition:

- Enabling the transition to a low-carbon energy economy

- Evolving global electricity markets to support a range of cost-effective technological options at a regional level beyond the confines and constraints of one jurisdiction or country

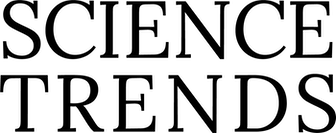

In this research, as shown in Figure 1, we highlight a strategic energy policy view to address these long-term challenges by introducing a Regional Energy Hub concept. The graphic illustrates a strategic view of energy policy considerations and requirements for a typical asset investment cycle in an electricity market in any country with a typical timeline, planning, construction, and operation of these assets for optimal outcomes. These development cycles are based on similar standards across jurisdictions that address the requirements of resource adequacy, reliability, and flexibility including approaches to capacity options. The general schematic is a characterization appropriate for developing or developed markets. This investment cycle is usually determined at the individual corporate or country level.

However, when a group of countries in a contiguous geographical region can operate through an integrated, enabling market with a long view (i.e. beyond ten years and longer), we see an opportunity for new value creation and a cost-effective transition to a low-carbon energy economy.

Figure 1: Markets’ Evolution to Capability Options. (Republished with permission)

REH Framework enables neighboring countries integrated through markets to invest in common interest assets (such as an interconnector), bringing to practical realization the most capable options for a region. This type of “common interest” but market-driven asset development cycle can be achieved for developing and developed markets.

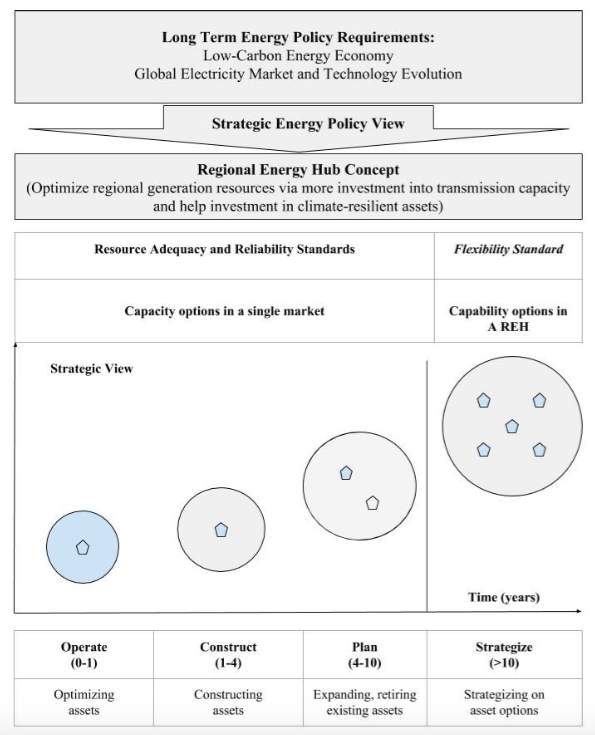

Figure 2: REH Framework (Republished with permission)

A REH Framework achieves this by employing four major parameters: geopolitical, economic, environmental, and financial. The geopolitical parameter allows countries, markets, and provinces to form broader alliances and essentially enforces them to rely more on trading than isolation among themselves. Additionally, this geopolitical parameter rests upon four indicators: (i) international economics, (ii) climate change with respect to transnational energy policies, (iii) seamless energy markets, and (iv) energy market regulations to capture the global energy sector related to institutional knowledge.

The geopolitical parameter enables REHs to be formed for a region’s benefits developing out of these indicators. On the other hand, the economic parameter optimizes the power generation mixes of this newly-formed REH that results in a cost reduction for the region. Meanwhile, the environmental parameter optimizes the region’s emissions rather than one nation’s emissions, which effectively helps management of carbon reductions to be able to meet the Paris agreement commitments. Finally, the financial parameter ultimately optimizes and potentially mobilizes resources toward a common interest project. Hence, the REH Framework manages the transition towards a low-carbon energy economy for the interest of energy policymakers, investors, and the public.

Once the corresponding REH is selected and evaluated, a common interest project for the REH can be achieved. Overall net benefit from these REH factors would lead to an investment decision while unlocking the region’s potential as a REH. In this context, we propose a formal definition of REH as follows:

Regional energy hub is an intersection point of all energy (electricity) supply and demand routes geographically originating, transiting, ending (centralizing) in a pre-defined region where there is an ultimate net benefit for that region from the following perspectives: geopolitical, economic, environmental, and financial. When the net benefit is evaluated (e.g., it is positive), there is a need for a transmission investment for that region.

Tomorrow’s grid will need to be highly “flexible” and resilient in order to maneuver around short-term challenges posed by extreme weather events such as hurricanes, floods, storms and extreme heat but also meet the long-term challenge of greenhouse gas mitigation through effective optimization of the energy supply mix at the regional level.

One part of the answer is to enable transmission investment and large-scale scale enhanced electricity trading among countries on a continent-wide basis. We expect a clear stipulation and definition of a regional energy hub (REHs) will play key roles in tomorrow’s flexible grid and markets, making them our most important asset, enabling REH Framework as a building block for a global energy interconnection.

We highlight the potential winners of a REH concept: transmission investments and distributed generation, clean & baseload providers of low carbon energy, and large-scale storage for enablement of the intermittency of renewables (wind and solar).

These findings are described in the article entitled A “Regional Energy Hub” for achieving a low-carbon energy transition, recently published in the journal Energy Policy. This work was conducted by Burak Guler and Jatin Nathwani from the University of Waterloo and Emre Çelebi from Kadir Has University.

References

- Guler, B., Çelebi, E., & Nathwani, J. (2018). A ‘Regional Energy Hub’ ’for achieving a low-carbon energy transition. Energy Policy , 1 13 , 376-385.

- Guler, B., Çelebi, E., & Nathwani, J. (2018). “Cost effective decarbonisation through investment in transmission interconnectors as part of an integrated Regional Energy Hubs (REH)”, Working Paper, University of Waterloo

The corresponding author of this article is Mr. Burak Guler, who can be reached a: [email protected]